Usage¶

Note

Please install or update TradingView_TA to the latest version. Please read the getting started guide before continuing.

Warning

TradingView_TA older than v3.2.0 is no longer supported. Please update using pip install tradingview_ta --upgrade.

Importing TradingView_TA¶

from tradingview_ta import TA_Handler, Interval, Exchange

import tradingview_ta

Checking the version¶

Starting from version 3.1.3, you can retrieve the version of TradingView_TA through the __version__ attribute.

print(tradingview_ta.__version__)

# Example output: 3.1.3

Instantiating TA_Handler¶

handler = TA_Handler(

symbol="",

exchange="",

screener="",

interval="",

timeout=None

)

Parameters:

symbol (

str) – Ticker symbol (e.g.,"AAPL","TLKM","USDEUR","BTCUSDT").exchange (

str) – Exchange (e.g.,"nasdaq","idx",Exchange.FOREX,"binance").screener (

str) – Screener (e.g.,"america","indonesia","forex","crypto").Note

- If you’re looking for stocks, enter the exchange’s country as the screener.

- If you’re looking for cryptocurrency, enter

"crypto"as the screener.- If you’re looking for forex, enter

"forex"as the screener.interval (

str) – Time frameNote

Please see the Interval class for available intervals.

class Interval: INTERVAL_1_MINUTE = "1m" INTERVAL_5_MINUTES = "5m" INTERVAL_15_MINUTES = "15m" INTERVAL_30_MINUTES = "30m" INTERVAL_1_HOUR = "1h" INTERVAL_2_HOURS = "2h" INTERVAL_4_HOURS = "4h" INTERVAL_1_DAY = "1d" INTERVAL_1_WEEK = "1W" INTERVAL_1_MONTH = "1M"timeout (

float, optional) – How long to wait (in seconds) for the server to return a response.

Retrieving the analysis¶

analysis = handler.get_analysis()

Note

analysis is an instance of Analysis class.

It contains information such as the exchange, symbol, screener, interval, local time (datetime.datetime), etc.

Attributes:

symbol (

str) – The symbol set earlier.exchange (

str) – The exchange set earlier.screener (

str) – The screener set earlier.interval (

str) – The interval set earlier.time (

datetime.datetime) – The time when the data is retrieved.summary (

dict) – Technical analysis (based on both oscillators and moving averages).# Example {'RECOMMENDATION': 'BUY', 'BUY': 12, 'SELL': 7, 'NEUTRAL': 9}oscillators (

dict) – Technical analysis (based on oscillators).# Example {'RECOMMENDATION': 'BUY', 'BUY': 2, 'SELL': 1, 'NEUTRAL': 8, 'COMPUTE': {'RSI': 'NEUTRAL', 'STOCH.K': 'NEUTRAL', 'CCI': 'NEUTRAL', 'ADX': 'NEUTRAL', 'AO': 'NEUTRAL', 'Mom': 'BUY', 'MACD': 'SELL', 'Stoch.RSI': 'NEUTRAL', 'W%R': 'NEUTRAL', 'BBP': 'BUY', 'UO': 'NEUTRAL'}}moving_averages (

dict) – Technical analysis (based on moving averages).# Example {'RECOMMENDATION': 'BUY', 'BUY': 9, 'SELL': 5, 'NEUTRAL': 1, 'COMPUTE': {'EMA10': 'SELL', 'SMA10': 'SELL', 'EMA20': 'SELL', 'SMA20': 'SELL', 'EMA30': 'BUY', 'SMA30': 'BUY', 'EMA50': 'BUY', 'SMA50': 'BUY', 'EMA100': 'BUY', 'SMA100': 'BUY', 'EMA200': 'BUY', 'SMA200': 'BUY', 'Ichimoku': 'NEUTRAL', 'VWMA': 'SELL', 'HullMA': 'BUY'}}indicators (

dict) – Technical indicators.# Example {'Recommend.Other': 0, 'Recommend.All': 0.26666667, 'Recommend.MA': 0.53333333, 'RSI': 60.28037412, 'RSI[1]': 58.58364778, 'Stoch.K': 73.80404453, 'Stoch.D': 79.64297643, 'Stoch.K[1]': 78.88160227, 'Stoch.D[1]': 85.97647064, 'CCI20': 46.58442886, 'CCI20[1]': 34.57058796, 'ADX': 35.78754863, 'ADX+DI': 23.16948389, 'ADX-DI': 13.82449817, 'ADX+DI[1]': 24.15991909, 'ADX-DI[1]': 13.87125505, 'AO': 6675.72158824, 'AO[1]': 7283.92420588, 'Mom': 1532.6, 'Mom[1]': 108.29, 'MACD.macd': 2444.73734978, 'MACD.signal': 2606.00138275, 'Rec.Stoch.RSI': 0, 'Stoch.RSI.K': 18.53740187, 'Rec.WR': 0, 'W.R': -26.05634845, 'Rec.BBPower': 0, 'BBPower': 295.52055898, 'Rec.UO': 0, 'UO': 55.68311917, 'close': 45326.97, 'EMA5': 45600.06414333, 'SMA5': 45995.592, 'EMA10': 45223.22433151, 'SMA10': 45952.635, 'EMA20': 43451.52018338, 'SMA20': 43609.214, 'EMA30': 41908.5944052, 'SMA30': 40880.391, 'EMA50': 40352.10222373, 'SMA50': 37819.3566, 'EMA100': 40356.09177879, 'SMA100': 38009.7808, 'EMA200': 39466.50411569, 'SMA200': 45551.36135, 'Rec.Ichimoku': 0, 'Ichimoku.BLine': 40772.57, 'Rec.VWMA': 1, 'VWMA': 43471.81729377, 'Rec.HullMA9': -1, 'HullMA9': 45470.37107407, 'Pivot.M.Classic.S3': 11389.27666667, 'Pivot.M.Classic.S2': 24559.27666667, 'Pivot.M.Classic.S1': 33010.55333333, 'Pivot.M.Classic.Middle': 37729.27666667, 'Pivot.M.Classic.R1': 46180.55333333, 'Pivot.M.Classic.R2': 50899.27666667, 'Pivot.M.Classic.R3': 64069.27666667, 'Pivot.M.Fibonacci.S3': 24559.27666667, 'Pivot.M.Fibonacci.S2': 29590.21666667, 'Pivot.M.Fibonacci.S1': 32698.33666667, 'Pivot.M.Fibonacci.Middle': 37729.27666667, 'Pivot.M.Fibonacci.R1': 42760.21666667, 'Pivot.M.Fibonacci.R2': 45868.33666667, 'Pivot.M.Fibonacci.R3': 50899.27666667, 'Pivot.M.Camarilla.S3': 37840.08, 'Pivot.M.Camarilla.S2': 39047.33, 'Pivot.M.Camarilla.S1': 40254.58, 'Pivot.M.Camarilla.Middle': 37729.27666667, 'Pivot.M.Camarilla.R1': 42669.08, 'Pivot.M.Camarilla.R2': 43876.33, 'Pivot.M.Camarilla.R3': 45083.58, 'Pivot.M.Woodie.S3': 21706.84, 'Pivot.M.Woodie.S2': 25492.42, 'Pivot.M.Woodie.S1': 34876.84, 'Pivot.M.Woodie.Middle': 38662.42, 'Pivot.M.Woodie.R1': 48046.84, 'Pivot.M.Woodie.R2': 51832.42, 'Pivot.M.Woodie.R3': 61216.84, 'Pivot.M.Demark.S1': 35369.915, 'Pivot.M.Demark.Middle': 38908.9575, 'Pivot.M.Demark.R1': 48539.915, 'open': 44695.95, 'P.SAR': 48068.64, 'BB.lower': 37961.23510877, 'BB.upper': 49257.19289123, 'AO[2]': 7524.31223529, 'volume': 32744.424503, 'change': 1.44612354, 'low': 44203.28, 'high': 45560}Tip

Useful indicators:

- Opening price:

analysis.indicators["open"]- Closing price:

analysis.indicators["close"]- Momentum:

analysis.indicators["Mom"]- RSI:

analysis.indicators["RSI"]- MACD:

analysis.indicators["MACD.macd"]

Retrieving multiple analysis¶

from tradingview_ta import *

analysis = get_multiple_analysis(screener="america", interval=Interval.INTERVAL_1_HOUR, symbols=["nasdaq:tsla", "nyse:docn", "nasdaq:aapl"])

Note

You can’t mix different screener and interval.

Parameters:

symbols (

list) – List of exchange and ticker symbol separated by a colon. Example: [“NASDAQ:TSLA”, “NYSE:DOCN”] or [“BINANCE:BTCUSDT”, “BITSTAMP:ETHUSD”].screener (

str) – Screener (e.g.,"america","indonesia","forex","crypto").timeout (

float, optional) – How long to wait (in seconds) for the server to return a response.additional_indicators (

list, optional) – List of additional indicators to retrieve. Example:["RSI", "Mom"].interval (

str) – Time frameNote

Please see the Interval class for available intervals.

class Interval: INTERVAL_1_MINUTE = "1m" INTERVAL_5_MINUTES = "5m" INTERVAL_15_MINUTES = "15m" INTERVAL_30_MINUTES = "30m" INTERVAL_1_HOUR = "1h" INTERVAL_2_HOURS = "2h" INTERVAL_4_HOURS = "4h" INTERVAL_1_DAY = "1d" INTERVAL_1_WEEK = "1W" INTERVAL_1_MONTH = "1M"

Note

get_multiple_analysis() returns a dictionary with a format of {“EXCHANGE:SYMBOL”: Analysis}.

# Example

{'NYSE:DOCN': <tradingview_ta.main.Analysis object at 0x7f3a5ba49be0>, 'NASDAQ:TSLA': <tradingview_ta.main.Analysis object at 0x7f3a5ba65040>, 'NASDAQ:AAPL': <tradingview_ta.main.Analysis object at 0x7f3a5ba801c0>}

Please use UPPERCASE letters when accessing the dictionary.

If there is no analysis for a certain symbol, Analysis will be replaced with a None. For example, BINANCE:DEXEUSDT does not have an analysis, but BINANCE:BTCUSDT has:

# Example

{'BINANCE:DEXEUSDT': None, 'BINANCE:BTCUSDT': <tradingview_ta.main.Analysis object at 0x7f3561cdeb20>}

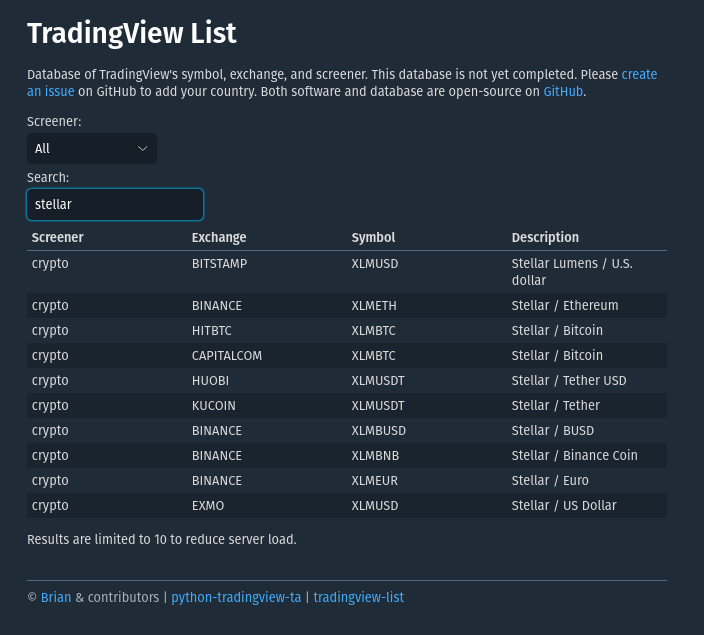

Symbol search¶

New in version 3.3.0.

Search for symbols using the TradingView symbol search API. Returns a list of symbols, exchanges, types, descriptions, and logo URLs matching the search query.

from tradingview_ta import TradingView

print(TradingView.search("tesla", "america"))

# Output: [{'symbol': 'TSLA', 'exchange': 'NASDAQ', 'type': 'stock', 'description': 'Tesla, Inc.', 'logo': 'https://s3-symbol-logo.tradingview.com/tesla.svg'}, ...]

Note

While symbols listed on https://tvdb.brianthe.dev are guaranteed to work with the “get analysis()” function, symbols returned by this function may not.

Parameters:

- text (

str) – Query string. - type (

str, optional) – Type of asset (stock, crypto, futures, index). Defaults to None (all).

Proxy¶

Simply add the proxies parameter if you wish to utilize a proxy. Works with both TA_Handler() and get_multiple_analysis(). It’s worth noting that a bad proxy could result in TradingView rejecting your request.

from tradingview_ta import TA_Handler, Interval, Exchange tesla = TA_Handler( symbol="TSLA", screener="america", exchange="NASDAQ", interval=Interval.INTERVAL_1_DAY, proxies={'http': 'http://0.0.0.0:8080', 'https': 'https://0.0.0.0:443'} ) print(tesla.get_analysis().summary) # Example output: {"RECOMMENDATION": "BUY", "BUY": 8, "NEUTRAL": 6, "SELL": 3}